AIM DTC LAUNCH - 26.02.26

Launching World’s First Digital Trade Corridor (DTC )

Africa-India-Middle East DTC

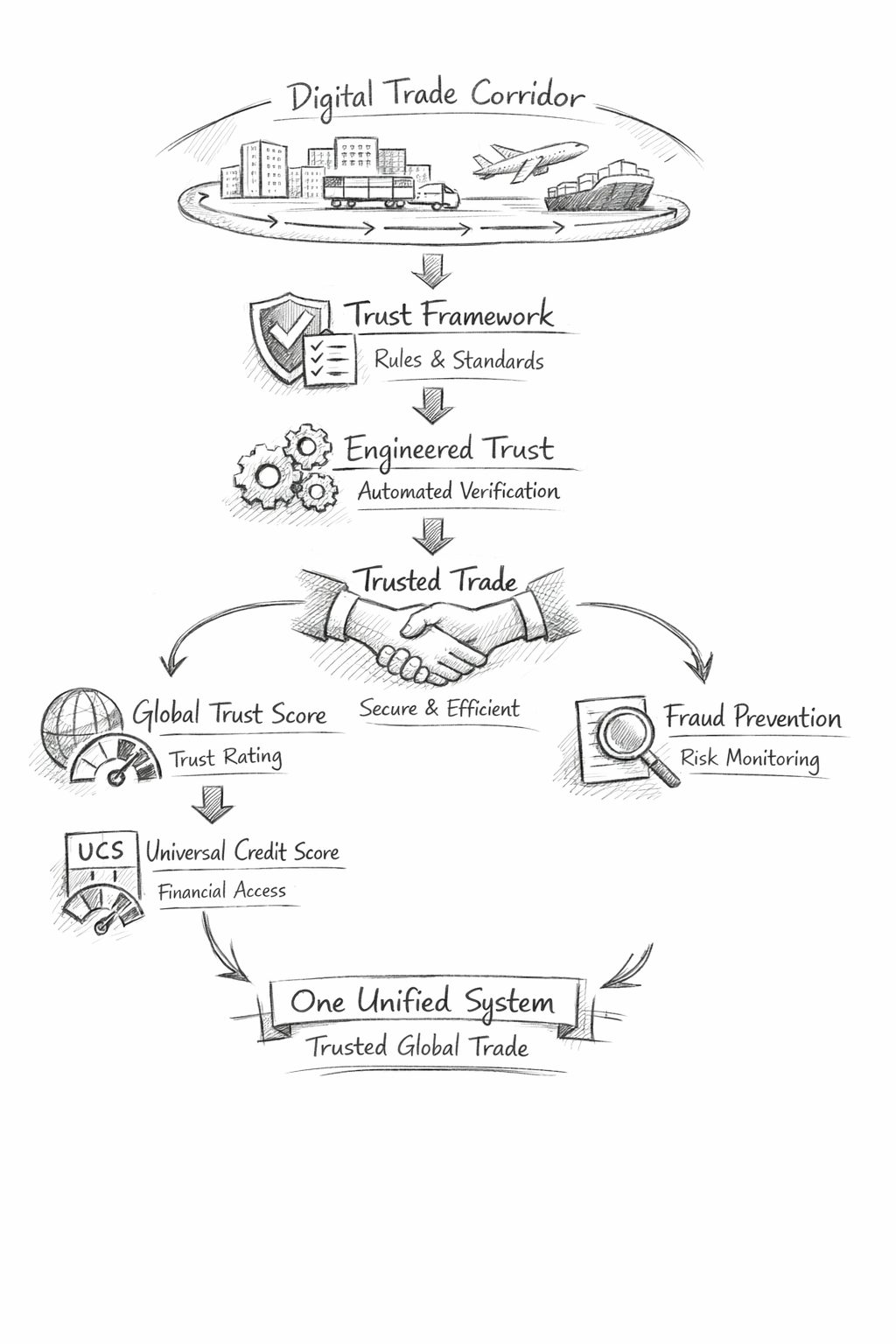

A unified digital corridor that connects buyers, sellers, banks, NBFCs, logistics providers, and

compliance systems—making global agricultural trade faster, safer, and finance-ready.

One Trade Corridor,31 Countries!

- Middle East: UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain, Jordan, Türkiye, Egypt, Israel

- Africa: Nigeria, South Africa, Kenya, Ethiopia, Ghana, Egypt, Tanzania, Uganda, Ivory Coast (Côte d'Ivoire), Senegal, Algeria, Morocco, Rwanda, Zambia, Mozambique, Angola, Cameroon, Sudan, DR Congo, Botswana