A unified digital infrastructure connecting verified global trade with Indian NBFC capital

Trade finance opportunities from World’s First Digital Trade Corridor

The

Africa, India & Middle East (AIM DTC) — powered by verification, trust

frameworks, and deal

intelligence.

Note: India’s agri import–export flows exceed $85 billion annually , creating a massive trade finance opportunity for you.

A GLOBAL INFRASTRUCTURE GAP

Global trade has evolved. Risk assessment hasn’t kept pace.

Cross-border trade moves in days, but risk assessment

still relies on slow,

fragmented information.

Trade Moves Fast. Risk Data Doesn’t.

Trade cycles compress into days, while verification, validation, and risk inputs remain delayed—creating timing gaps in financing decisions.

Borrower Profiles Mask Transaction Reality.

Most financing decisions rely on entity-level data, even though every trade carries its own economics, execution quality, and counterparty behaviour.

Strong Deals Exist—But Hard to See.

High-quality cross-border transactions often go unfunded due to fragmented verification and lack of structured, deal-ready intelligence.

INFRASTRUCTURE FOR TRADE & FINANCE

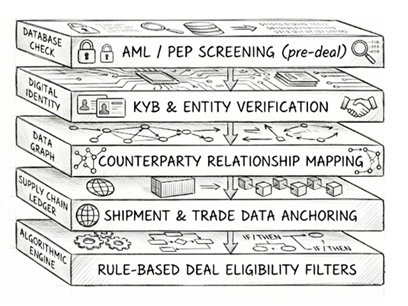

A unified, verification-first environment where global trade and Indian capital connect

A Digital Trade Corridor is an always-on

digital environment where exporters, importers, logistics, insurers, and

lenders operate under

shared rules, verified identities, and standardized trade data.

Access Global Trade—From

India.

Access verified cross-border trade flows from India without overseas branches or fragmented origination.

See the Transaction, Not Just

the Borrower.

Get structured, transaction-level insights on execution, counterparties, and performance for stronger credit decisions.

Verified Counterparties, 200+

Countries.

Validated global counterparties across 200+ countries through embedded AML, KYC, KYB, and PEP checks.

INTEGRATED TRADE & FINANCE

We’re World’s First Integrated Platform

for Agri-Trade & Trade Finance!

Built to make global Agri-trade transparent, secure, and finance-ready by design.

Access Agri Traders here!

A trusted marketplace for Agri Trade where verified counterparties meet—every trade is visible from discovery to execution.

Agri Traders access Credit here!

A transparent marketplace for Trade Finance where verified trades meet structured finance—from RFQ to settlement, every step is protected.

GLOBAL ACCESS

Participate in verified cross-border trade from Africa & the Middle East.

Access structured global trade flows across key corridors through a single digital

environment—eliminating

geographic barriers and fragmented origination.

Global trade access, delivered through verification and control

- not assumptions.

TRANSACTION VISIBILITY

Move beyond borrower profiles to transaction-level insight.

Each trade generates structured intelligence on execution, counterparties, and

performance—supporting faster,

more accurate, deal-specific risk assessment.

Price, approve, and deploy capital with deal-specific clarity, powered by live

transaction intelligence.

ZERO-COST ACCESS

A first-of-its-kind trust infrastructure for global trade and finance.

Embedded AML, KYC, KYB, and PEP checks ensure regulator-aligned cross-border trust.

For the first time, all participants in global trade—NBFCs and counterparties alike —are digitally verified at zero cost.

Every entity, every transaction, every corridor—

verified once,

trusted everywhere.

Standardized rules and real-time verification powering global trade

Infrastructure, rules, and automated enforcement transform trust from assumption

into

measurable, system-level assurance across global trade.